Card Options

Please select a card type below for more information.

Report Lost or Stolen Debit Cards

302-226-9800

After business hours 800-500-1044

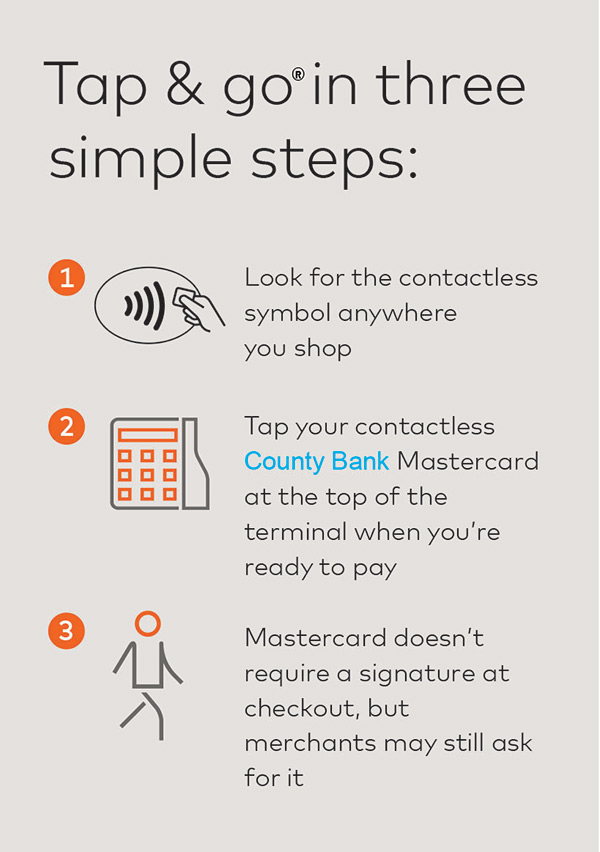

Steps in order

- Look for the contactless symbol anywhere you shop.

- Tap you contactless County Bank Mastercard at the top of the terminal when you’re ready to pay.

- Mastercard doesn’t require a signature at checkout, but merchants may still ask for it.

County Bank contactless chip consumer debit cards

- Buy online and in-store with security and peace of mind

- Tap to pay in stores where you see the contactless symbol

Confidence is built in.

Chip Card Security

An embedded microchip in the card creates a dynamic code that is nearly impossible to counterfeit, making transactions more secure.

Enhanced ID Theft Protection

Includes ID theft monitoring features and, should you become the victim of identity theft, expert assistance is available.*

Extra reassurance you can use.

Extended Warranty

Doubles the time period and duplicates the coverage of the original manufacturer’s or U.S. store brand’s warranty for a maximum of one year.**

Mastercard Global Service®

Call us for help for all of your account related questions or concerns, anytime, anywhere: 1-800-MASTERCARD (1-800-627-8372).

Contactless

Tap & Go® with your County Bank Debit Mastercard® today.

The speed and convenience of tapping with the same security as a chip. Pay at the checkout faster, and earn rewards quicker, on just about everything you buy every day. For takeout, groceries, gas and more, just Tap & Go.

- Faster checkouts: A simple tap is all it takes at millions of places you already shop.

- Greater security: Enhanced chip security.

- Cleaner alternative: Only you touch your card at checkout because no one else needs to.

How safe are contactless transactions?

This contactless card uses the latest chip security, so it is just as safe as inserting a chip card. When used at a chip-enabled terminal, it is protected by a one-time-use code that changes each time you use it.

How do I know if the merchant accepts it?

Just look for the universal contactless symbol at checkout or ask the cashier if you can pay by tapping. If they do not yet offer contactless, this card can be used normally at any merchant that accepts Mastercard.

Are there any transaction limits when I use it?

You can pay with your contactless card for everything you normally would and earn all of your same Kasasa® rewards and benefits. You may be asked to enter a PIN if the purchase is over $100.

Chip Technology

Convenience and enhanced security.

Your new County Bank Debit Mastercard® has an embedded chip that allows payment information to be securely transmitted at a chip-enabled terminal. This technology provides an enhanced level of security and greater worldwide acceptance.

What makes chip technology more secure?

The chip technology provides stronger protection by making it difficult for your card to be copied or counterfeited at chip-enabled terminals as a unique code is created for each transaction.

Where can I use my card?

You can use your card at anywhere Mastercard® is accepted. In addition to using your card at chip-enabled terminals, your card has a magnetic stripe allowing you to use it at retailers who do not yet have chip-enabled terminals.

How do I use my Debit Card at a retailer that is not yet chip-enabled.

Your card is also equipped with magnetic stripe technology, so you can swipe your card like you do today at retailers that are not yet chip-enabled. For online or phone purchases, simply provide your card number and complete your transaction as you do today.

How It Works

At a Non-Chip Terminal

Simply swipe your card, then press “Credit” and sign for your purchases or press “Debit” and enter your PIN, if necessary.

At a Chip-Enabled Terminal

- Insert the chip portion of the card into the terminal with the chip facing up. It’s important to leave the card in the terminal until the transaction is complete – if you remove the card too soon, the transaction will end, and your purchase will not be processed

- Follow the prompts on the terminal’s screen. Depending on the terminal, you may or may not be asked to enter your PIN while your card is in the terminal

- View transaction amount. The terminal will display the purchase amount

- Once the transaction is approved, you will be prompted to remove your card and take your receipt. You may be asked to sign the receipt for the transaction if you weren’t prompted to enter your PIN

Online and Phone Transactions

These types of transactions will be conducted the same way they are today and do not require a PIN.

*This benefit is provided by Generali Global Assistance Inc. Certain terms, conditions and exclusions apply. Please see your Guide to Benefits for details or call 1-800-MASTERCARD. Cardholders need to register for this service. Visit https://mastercardus.idprotectiononline.com/enrollment/embedded.html for more information and to activate the benefit.

**Benefits are subject to terms, conditions and limitations, including limitations on the amount of coverage. Coverage is provided by New Hampshire Insurance Company, an AIG company. Policy provides secondary coverage only.

All third-party trademarks are the property of their respective owners.

Mastercard, Mastercard Global Service, Cirrus and tap & go are registered trademarks, and the circle design is a trademark, of Mastercard International Incorporated.. ©2020 Mastercard. All rights reserved.

The gift of choice

Why not leave the buying decisions in their hands? Visa® Gift Cards offer the gift of choice – they may be used anywhere Visa debit cards are accepted within the United States and countries considered to be U.S. territories.

Visa Gift Cards are the ideal choice because it is:

- Convenient – May be used anywhere Visa debit cards are accepted within the United States and countries considered to be U.S. territories.

- Flexible – shop in-store. online or by phone

- Accessible – check balances online or by phone.

Standard text message and data rates, fees, and charges may apply.

Visa Gift Cards are perfect for any occasion, including:

- Wishing a happy holiday

- Spreading birthday cheer

- Congratulating graduates

- Incentivizing a job well done

- Celebrating a new baby

- Giving gifts to a lengthy list of recipients

- The possibilities are endless!

County Bank Gift Cards provide you and your recipient with freedom and flexibility. Gift Cards are great to both give and receive. Useful for special occasions Gift Cards can also help you manage your spending. County Bank is pleased to offer Gift Cards as an additional option in our suite of products and services.

Stop by any of our 7 convenient branch locations to purchase Gift Cards today.

Gift Cards:

- Purchase Fee $3.95

- Inactivity Fee $4.95 after 12 consecutive months of inactivity

- Lost/Stolen Replacement Fee $8.00

Gift Cards may only be purchased by County Bank customers at our branch locations.

You may purchase Gift Cards in amounts from $10.00 to $1,000.00.

Your card may be used anywhere Visa debit cards are accepted within the United States and countries considered to be U.S. territories. Your card can also be used for online and telephone purchases once the card has been registered. At point-of-sale, use your Gift Card as a signature based transaction. Select the “credit” option. You may obtain a Personalized Identification Number (PIN) by calling the number on the back of the Gift Card and following the automated instructions. After obtaining a PIN, you may select the “debit’’ option at point-of-sale. Your Gift Card cannot be used at ATMs or be used to obtain cash back in any purchase transaction.

Your funds are FDIC insured if you simply register the Gift Card by visiting www.gocardservices.com or by calling 1-866-261-7741.

You can also review balance and current transactions by logging into www.gocardservices.com or by calling 1-866-261-7741.

Visa® Gift Cards are issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc.

The convenient, all-purpose solution

Looking for a handy, flexible solution for managing the money you have and the money you’re spending? Look no further than a Visa® Reloadable Card.

Visa Reloadable Card is the ideal choice because it is:

- Convenient – easily reload funds online, in-branch, by mobile check capture or via direct deposit

- Secure – spend confidently online with a card unattached to your checking or savings account

- Accessible – check balances online or by phone

Visa Reloadable Cards are the best option – here’s why:

- You can’t overspend – the card prevents over-the-limit expenses

- You can have the monthly fee waived – just set up a regular direct deposit

- You have ATM access – check balances and withdraw funds worldwide*

It’s easy to get control of your spending with the convenience of a County Bank Reloadable Visa Card. Just load your card and go. The Card is instant issued upon purchase for your immediate use and a personalized card will be mailed after your second reload. The County Bank Reloadable Visa Card can be used wherever Visa debit card are accepted excluding current OFAC sanctioned or prohibited countries.

With monthly direct deposit reloads your Monthly Fee is waived. You can pay bills online, get ATM cash*, or use the card in stores. Make purchases online or over the phone. Your account is viewable by mobile device, online and you can set up text alerts**.

Stop by any of our 7 convenient branch locations to purchase County Bank Reloadable Cards today.

County Bank Reloadable Cards:

| Purchase Fee | $6.95 |

| Secondary Card Purchase Fee | $2.95 |

| Monthly Fee (primary card only) | $4.95 (Monthly fee will not be charged in any calander month in which you load your card) |

| Add Money (primary card only): | |

| At Financial Institution | $3.00 |

| Cash Access Fee: | |

| ATM Withdrawal, In Network | $0 |

| ATM Withdrawal, Out of Network | $1.99 (Third-party fees may apply.) |

| Over-the-Counter Cash Withdrawal | $1.99 (Third-party fees may apply.) |

| Foreign Transaction Fee | 3% |

| ATM Fees | When you use an ATM, you may be charged a fee by third-parties to complete the transaction. Fee may include balance inquiry. |

County Bank Reloadable Cards may only be purchased by County Bank customers at our branch locations.

You may initially purchase County Bank Reloadable Cards in amounts from $20.00 to $3,000.00.

Your funds are FDIC insured upon registration. You may review balance and transaction history by logging into www.gocardservices.com or by calling 1-866-261-7741.

Mobile remote check capture reloads are provided by the Ingo Money Network owned by Ingo Money, Inc. All checks are subject to approval for funding by Ingo™ at its sole discretion. Fees and other terms and conditions may apply. Visit http://ingomoney.com for more information about this service. The free Ingo™ Money app can be downloaded from the App Store ® or Google Play ™.

Ingo Money Disclaimer: Ingo Money is a service provided by Ingo™ Money, Inc. and First Century Bank, N.A., subject to the Ingo Money and First Century Bank Terms and Conditions, and Privacy Policy. Approval usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Unapproved checks will not be loaded to your card. Ingo Money reserves the right to recover funds from bad checks if you knew the check was bad when you sent it, if you attempt to cash or load it elsewhere after funding or if you otherwise act illegally or fraudulently. Fees may apply to loading or use of your card. Contact your card issuer for details.

*When you use an ATM you may be charged a fee to complete the transaction. This fee may include balance inquires.

**Standard text message and data rates, fees and charges may apply.

Visa® Prepaid Cards are issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc.

The County Bank Hometown Card with Worldwide Acceptance

When you use the County Bank Visa® or MasterCard® credit card for the purchases of goods or services, the following benefits are yours:

- Travel Reservation Service

- Bonus Travel Dividends

- Vision Discounts

- Prescription Discounts

- Payment Card Registration

- Quarterly Newsletter

- Key Registration

- Auto Rental Discount

Applications for County Bank Visa® and MasterCard®credit cards are available at any of our 7 convenient branch locations. Stop by to speak with our branch representatives today. Local people. Local decisions.

You may review balance and transaction history 24/7 by logging into www.mycardstatement.com, or by calling Card Holder Servicing at 1-800-423-7503.

For LOCAL Customer Service call us at 226-9800.

For your convenience bill payments may be made in any of our branch locations