System Upgrade

Available on 4/12/21 – 4/22/21 Business Preview Login

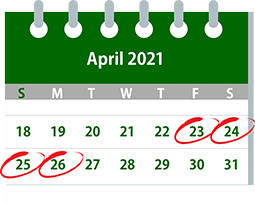

County Bank is pleased to announce that we are upgrading our banking technology to improve your banking experience with us. During the period from Friday, April 23 until Monday, April 26, we will be installing a new, state-of-the-art data processing system.

Products and Services That Will Remain the Same

Your day-to-day branch experience will be virtually unchanged. Your existing debit and credit cards will continue to be operable, your deposit account number(s) will remain unchanged and you should continue to use your existing checkbook.

Temporary Service Interruption during the Upgrade Period

We are pleased to announce the implementation of an enhanced new online banking system.

County Bank’s Online, Mobile, Touch Tone Banking, Mobile Deposit and Bill Payment will be temporarily unavailable as we make these enhancements.

What You Need to Know

ATMs

ATMs will be available, but balances inquiries on ATM’s will not be available during the weekend.

Branch Locations

Branch Locations will be open during normal business hours

Customer Support

Customer support will be open during normal business hours.

Phone 302-226-9800 or e-mail support@countybankmail.com

Debit and Credit Cards

Debit and Credit Cards will be operable as normal.

Direct Deposit

Since your account number and the bank’s routing number are not changing direct deposits will continue to process normally.

Consumer Online Banking

There will be a new Online Banking system available on our website April 26, 2021. The current Online Banking will disable at 1 p.m. EST Friday, April 23.

General Information:

- Check Register: Check Register Categories will not transfer over. We encourage downloading or printing your check register information prior to 4/23/2021 for your records.

- eBills: eBills will not convert to new system. You will need to be re-established eBills with your billing vendor.

- eStatements: If you currently receive eStatements you MUST re-enroll your selected accounts in the service. You will be prompted to enroll upon login to the new system.

We recommend printing or saving account statements prior to the conversion. - Nicknames: Online Banking Account Nicknames will not transfer over to the new system.

- Transaction History: 90 days of transaction history will be available upon login.

Bill Payment

Bill Payment will be disabled at 8 a.m. EST Friday, 4/23/21. The new system will be active 4/26/21.

Bill Payments will be converted to the new system.

Bill Payments previously scheduled to post 4/23 through 4/29 will not be viewable to you in the new system. THESE PREVIOUSLY SCHEDULED PAYMENTS WILL PROCESS ON THEIR DESIGNATED PAY DATES. We recommend keeping a record or printing your payment history through 4/29 so you do not mistakenly duplicate payments. The history will become available 5 business days after the conversion to the new system.

Bill Pay Prior to Conversion: What you need to do NOW to prepare for the upgrade:

PRINT THE ENTIRE “PAYMENT CENTER SCREEN” so that you have a record of all your payees (payees will convert) to verify information after conversion. Also make note of what “REMINDERS” you have set up (reminders will not convert over).

To ensure the accuracy of all information that will be transmitted from the current Bill Pay system, OBTAIN A CURRENT COPY OF EACH OF YOUR BILLS, AND VERIFY & UPDATE EACH PAYEE AS NEEDED MAKE A NOTE OF ANY PAYMENT REMINDERS, PAYMENT MEMOS AND PAYEE NOTES AS THESE WILL NOT CONVERT OVER.

We recommend deactivating e-bills and re-signing up after the conversion.

Payment Reminders do not convert over.

Payment Memo data does not convert over.

Bill Pay after the Conversion:

Select or verify the primary funding account if you have multiple funding accounts. An account has been selected as your default funding account during conversion.

Using the most current statement or bill verify the following for ALL PAYEES:

- Payee Names. Be sure that you are able to differentiate between two payees with the same name

- Payment addresses (the mailing address that you would use if you mailed your payment) NOTE: If the system has a managed relationship with a vendor, you may see “Address On File” in place of the physical address. These addresses do not need to be verified.

- Payee phone numbers

- Your account number with payee

- Pending payment amounts, recurring payments, and due dates

Mobile App

The County Bank Mobile App will be unavailable after 1 p.m. EST 4/23/21. There will be a new app available in your app stores for download soon. New tablet applications will also be available. Mobile Banking Users need to establish permanent credentials within Online Banking before attempting to login to the Mobile App. Failure to do so will result in a 24 hour lockout period.

For Sprint customers who do not receive a security pin Text “Allow 32858” to the number 9999.

For T-Mobile users who do not receive a security pin contact your carrier to unblock short codes.

Mobile Remote Deposit

Cut off time is 1:00 p.m. EST on Friday 4/23/21. The new mobile remote deposit will become available with the new application.

Quicken

ATTENTION QUICKEN AND QUICKBOOKS USERS

This upgrade will require that you make changes to your Quicken and/or QuickBooks software, so please take action to ensure a smooth transition. Prior Quicken and/or QuickBooks reports may not be accessible. We recommend exporting and saving any report history prior to the conversion.

As part of the System Upgrade users will need to deactivate and reactivate accounts in both Quicken and/or QuickBooks services. Please review the conversion instruction guides.

Your Quicken and QuickBooks Action Dates:

- 1st Action Date prior to 4/23/21

- 2nd Action Date after 4/26/21

Conversion instructions

Important Information - Quicken and QuickBooks aggregation services will be interrupted for up to 5 business days. Users are encouraged to download a QFX/QBO file during this outage.

Transfers

Pending transfers will be converted to the new system. We encourage keeping a record of any scheduled pending transfers. Transfers access will disable at 1 p.m. Friday 4/23/21.

Any Recurring Transfers created and scheduled on or after 4/2/2021 by you will need to be re-entered after the system conversion.

First Time Login Process for Current Consumer Online Banking Users:

- Go to the Online Banking login box on the County Bank website Home Page https://www.countybankdel.com/

- Type in your current User Id

- Next get an authenticate code by selecting the phone number to which you would like to receive a phone call or text. If you choose to receive a call you will be presented a code on Online Banking to be spoken or keyed into the phone to validate. If you choose to receive a text message a code will be texted and you will add the code to the provided field on Online Banking.

- Enter your temporary password. (Last 6 digits of your social security number)

- Accept the Online Banking & Bill Pay Agreement. You must click on the link to view.

Exit the Internet Banking and Bill Payment Agreement page in your web browser by using the “X” button on the page’s tab header. - Select a new password

- Enroll in eStatements

- Set account alerts

Please contact us if you are having difficulties with the first time login process. We are here to help.

Business Online Banking

There will be a new Online Banking system available on our website April 26, 2021. The current Online Banking will disable at 1 p.m. EST Friday, April 23.

Preview Period: Join us during the preview period starting at 9 a.m. EST on 4/12/21 through 5 p.m. EST 4/22/21 for you to gain familiarity with the new online banking site. Login and navigate the new system. During this period there are no transactions on the new system, but Primary / Focus customers may add users, update information and set up Transfer, ACH and Wire templates.

Available on 4/12/21 – 4/22/21 Business Preview Login

Prior to Conversion: What you need to do NOW to prepare for the upgrade:

General Information:

- Company ID’s: New Company ID’s will be forwarded. These ID’s are an added layer of security used at login.

- Check Register: Check Register Categories will not transfer over. We encourage downloading or printing your check register information prior to 4/23/2021 for your records.

- eBills: eBills will not convert to new system. You will need to be re-established eBills with your billing vendor.

- eStatements: If you currently receive eStatements you MUST re-enroll your selected accounts in the service. Primary / Focus customers select under the Reports tab Statements and Documents to enroll. We recommend printing or saving account statements prior to the conversion.

- Nicknames: Online Banking Account Nicknames will transfer over to the new system.

- Other Accounts: Loan and CD account information will be viewable on Tuesday 4/27/21

- Sub Users: Secondary or Sub Users will be accessible but their service and account entitlements will need to be re-established by the Primary / Focus User.

- Transaction History: 90 days of transaction history will be available upon login.

ACH

Last Date ACH Batches Should Be Added is 4/21/21 1 p.m. EST

ACH Batches Scheduled through Friday, 4/23 by 10 a.m. EST will be Processed on Friday.

Last Date for ACH Batches to be Processed is 4/23/21 by 1:00 p.m. EST

ACH templates will not convert to the new system.

Export ACH Templates prior to 4/23/2021 and save them using “I Want To” button. These may be imported to the new system on 4/26/2021, or during the Preview Period 4/12/21 through 4/22/21.

Bill Payment

Secondary Users in Bill Pay will not convert to the new system.

Bill Payment will be disabled at 8 a.m. EST Friday, 4/23/21. The new system will be active 4/26/21.

Bill Payments will be converted to the new system.

Bill Payments previously scheduled to post 4/23 through 4/29 will not be viewable. THESE PREVIOUSLY SCHEDULED PAYMENTS WILL PROCESS ON THEIR DESIGNATED PAY DATES. We recommend keeping a record or printing your payment history through 4/29 so you do not mistakenly duplicate payments.

- eBills: eBills will not convert and will need to be reestablished with your biller.

- Nicknames: Payee Nicknames will convert.

- Payees: Please review all payee account information post system change to ensure that the address and account numbers are correct.

- Transaction History. The prior 6 months payment history will become available after 4/29.

The history will become available 5 business days after the conversion to the new system.

Bill Pay Prior to Conversion: What you need to do NOW to prepare for the upgrade:

PRINT THE ENTIRE “PAYMENT CENTER SCREEN” so that you have a record of all your payees (payees will convert) to verify information after conversion. Also make note of what “REMINDERS” you have set up (reminders will not convert over).

To ensure the accuracy of all information that will be transmitted from the current Bill Pay system, OBTAIN A CURRENT COPY OF EACH OF YOUR BILLS, AND VERIFY & UPDATE EACH PAYEE AS NEEDED MAKE A NOTE OF ANY PAYMENT REMINDERS, PAYMENT MEMOS AND PAYEE NOTES AS THESE WILL NOT CONVERT OVER.

We recommend deactivating e-bills and re-signing up after the conversion.

Payment Reminders do not convert over.

Payment Memo data does not convert over.

Bill Pay after the Conversion:

Select or verify the primary funding account if you have multiple funding accounts. An account has been selected as your default funding account during conversion.

Using the most current statement or bill verify the following for ALL PAYEES:

- Payee Names. Be sure that you are able to differentiate between two payees with the same name

- Payment addresses (the mailing address that you would use if you mailed your payment) NOTE: If the system has a managed relationship with a vendor, you may see “Address On File” in place of the physical address. These addresses do not need to be verified.

- Payee phone numbers

- Your account number with payee

- Pending payment amounts, recurring payments, and due dates

Merchant Remote Deposit

Cut off time is 1:00 p.m. EST on Friday 4/23/21.

Mobile App

The County Bank Mobile App will be unavailable after 1 p.m. EST 4/23/21. There will be a new app available in your app stores for download soon. New tablet applications will also be available. Mobile Banking Users need to establish permanent credentials within Online Banking before attempting to login to the Mobile App. Failure to do so will result in a 24 hour lockout period.

For Sprint customers who do not receive a security pin Text “Allow 32858” to the number 9999.

For T-Mobile users who do not receive a security pin contact your carrier to unblock short codes

Mobile Remote

Cut off time is 1:00 p.m. EST on Friday 4/23/21

Quickbooks

ATTENTION QUICKEN AND QUICKBOOKS USERS

This upgrade will require that you make changes to your Quicken and/or QuickBooks software, so please take action to ensure a smooth transition. Prior Quicken and/or QuickBooks reports may not be accessible. We recommend exporting and saving any report history prior to the conversion.

As part of the System Upgrade users will need to deactivate and reactivate accounts in both Quicken and/or QuickBooks services. Please review the conversion instruction guides.

Your Quicken and QuickBooks Action Dates:

- 1st Action Date prior to 4/23/21

- 2nd Action Date after 4/26/21

Conversion instructions

Important Information - Quicken and QuickBooks aggregation services will be interrupted for up to 5 business days. Users are encouraged to download a QFX/QBO file during this outage.

Transfers

Any Pending Transfers will not post. They will need to be reset up. We recommend printing out transfer information prior to the conversion.

Wires

Online Wire Cut off Time is 1:00 p.m. EST on Friday 4/23/21

Branch Wire Cut off Time is 4:00 p.m. EST on Friday 4/23/21

Wire Templates will not convert to the new system. They will need to be re-entered. We recommend saving information and reentering on 4/26/2021, or during the Preview Period 4/12/21 through 4/22/21.

First Time Login Process for Current Business Online Banking Users:

- Go to the Online Banking login box on the County Bank website Home Page https://www.countybankdel.com/

- Type in your current User Id. (Please note: If you have any special characters or spaces in your current User Id these are removed from your new User ID for the first time login process.) User Id’s are NOT case sensitive.

- Type in your Company ID

- Next get an authenticate code by selecting the phone number to which you would like to receive a phone call or text. If you choose to receive a call you will be presented a code on Online Banking to be spoken or keyed into the phone to validate. If you choose to receive a text message a code will be texted and you will add the code to the provided field on Online Banking.

- Enter your temporary password. (Type “D1b1” followed by the first four (4) characters of your User Id in uppercase) The Temporary Password is case sensitive.

- Select a new password

- Enroll in eStatements. Primary / Focus Users select under the Reports tab Statements and Documents to enroll.

- Set up account alerts

Please contact us if you are having difficulties with the first time login process. We are here to help.